How To Calculate The Gross Profit Ratio ?

Knowing a company’s gross profit ratio is useful in determining how efficiently it uses its resources.

Regardless of the goods or services an organization is selling, calculating the optimum way to use its labor and materials is likely to have an impact on its long-term success.

A company’s gross profit ratio is a valuable piece of information, but it requires knowledge of key figures regarding the organization’s sales and costs. In this article, we will discuss what gross profit ratio is, why is it important and how you can calculate it.

What is the Gross Profit Ratio?

Gross profit ratio (GP ratio) is a financial ratio that measures the performance and efficiency of a business by dividing its gross profit figure by the total net sales.

The gross profit ratio can also be expressed in percentage form, multiplying the result by 100. It is then called gross profit percentage or gross profit margin.

Calculating the company’s gross profit figure is done by determining the total sales over a certain period of time and deducting the total costs of the labor and materials used to create the goods and services that the organization is selling. The company’s net sales figure represents all its gross sales over a certain period of time, as well as income from other sources, such as interest, rented properties, royalties, or others, minus its returns, allowances and discounts.

Why is Gross Profit Ratio Important?

The gross profit ratio’s main value is being an accurate indicator of how efficiently a company is selling its goods and services. This will give the organization’s management and potential investors a view of how well the company manages to optimize its processes, keep the costs to a minimum and produce the highest possible profit.

Some of the main reasons why gross profit ratio is important are:

It gives management a clear idea of how much capital they can reinvest

Knowing how much of your revenue is left after accounting for all the expenses is crucial because it shows management how much of the revenue they can reinvest in the company. A high gross profit ratio allows the people responsible for growing the organization to allocate resources for increasing brand awareness, hiring new personnel and other ways to enhance the company.

How do you calculate profit rate?

Profit margin is the ratio of profit remaining from sales after all expenses have been paid. You can calculate profit margin ratio by subtracting total expenses from total revenue, and then dividing this number by total expenses. The formula is: ( Total Revenue – Total Expenses ) / Total Revenue.

How do I calculate gross profit on a calculator?

How to calculate profit margin

- Find out your COGS (cost of goods sold). …

- Find out your revenue (how much you sell these goods for, for example $50 ).

- Calculate the gross profit by subtracting the cost from the revenue. …

- Divide gross profit by revenue: $20 / $50 = 0.4 .

- Express it as percentages: 0.4 * 100 = 40% .

How do you calculate gross profit example?

You can find the gross profit by subtracting the cost of goods sold (COGS) from the revenue. For example, if a company had $10,000 in revenue and $4,000 in COGS, the gross profit would be $6,000. This figure is on your income statement.

How do I calculate profit percentage?

Determine your business’s net income (Revenue – Expenses) Divide your net income by your revenue (also called net sales) Multiply your total by 100 to get your profit margin percentage.

What is the gross profit method?

Gross profit method.

The gross profit method estimates the value of inventory by applying the company’s historical gross profit percentage to current‐period information about net sales and the cost of goods available for sale. Gross profit equals net sales minus the cost of goods sold.

Gross Profit Margin

Gross profit margin is a profitability ratio that calculates the percentage of sales that exceed the cost of goods sold. In other words, it measures how efficiently a company uses its materials and labor to produce and sell products profitably. You can think of it as the amount of money from product sales left over after all of the direct costs associated with manufacturing the product have been paid. These direct costs are typically called cost of goods sold or COGS and usually consist of raw materials and direct labor.

The gross profit ratio is important because it shows management and investors how profitable the core business activities are without taking into consideration the indirect costs. In other words, it shows how efficiently a company can produce and sell its products. This gives investors a key insight into how healthy the company actually is. For instance, a company with a seemingly healthy net income on the bottom line could actually be dying. The gross profit percentage could be negative, and the net income could be coming from other one-time operations. The company could be losing money on every product they produce, but staying a float because of a one-time insurance payout.

That is why it is almost always listed on front page of the income statement in one form or another. Let’s take a look at how to calculate gross profit and what it’s used for.

Formula

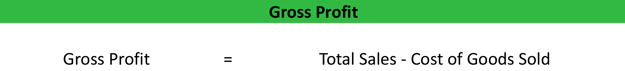

The gross profit formula is calculated by subtracting total cost of goods sold from total sales.

Both the total sales and cost of goods sold are found on the income statement. Occasionally, COGS is broken down into smaller categories of costs like materials and labor. This equation looks at the pure dollar amount of GP for the company, but many times it’s helpful to calculate the gross profit rate or margin as a percentage.

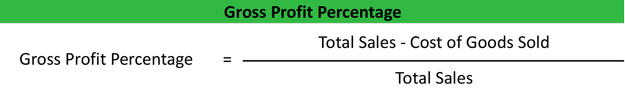

The gross profit percentage formula is calculated by subtracting cost of goods sold from total revenues and dividing the difference by total revenues. Usually a gross profit calculator would rephrase this equation and simply divide the total GP dollar amount we used above by the total revenues. Both equations get the result.

Example

Monica owns a clothing business that designs and manufactures high-end clothing for children. She has several different lines of clothing and has proven to be one of the most successful brands in her space. Here’s what appears on Monica’s income statement at the end of the year.

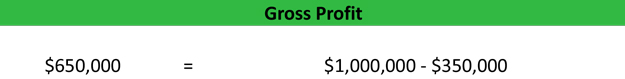

Total sales: $1,000,000

COGS: $350,000

Rent: $100,000

Utilities: $10,000

Office expenses: $2,500

Monica has an upcoming meeting with investors and wants to know how to find gross profit and what method to use. First, we can calculate Monica’s overall dollar amount of GP by subtracting the $350,000 of COGS from the $1,000,000 of total sales like this:

also read :

- how to share screen on facetime? ios 15 on iphone, ipad and mac + Videos

- The winner of the Nobel Prize in physics are : Syukuro Manabe, Klaus Hasselmann and Giorgio Parisi + bio

- Super Smash Bros. Ultimate : Halo Developer Says Master Chief Won’t Appear

- Duffy Shares ‘Passing Thoughts’ With Fans On Instagram Social media

- Lin-Manuel Miranda Directs Andrew Garfield as ‘Rent’ Creator Jonathan Larson

- What Time Will On My Block season 4 release time on Netflix ?

- Titanic : Kate Winslet liked to act in a sex scene with a woman more

how to calculate gross profit margin

Gross profit margin ratio

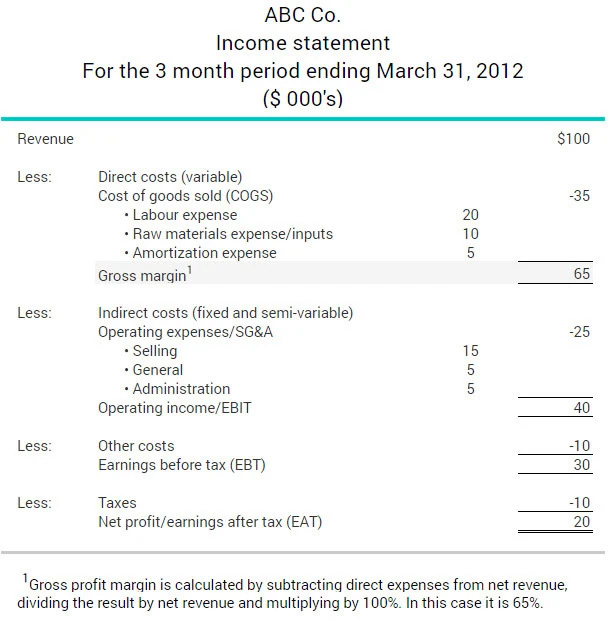

The gross profit margin ratio shows the percentage of sales revenue a company keeps after it covers all direct costs associated with running the business. It is one of five calculations used to measure profitability. The others are return on shareholders’ equity, the net profit margin ratio, return on common equity and return on total assets.

Gross profit margin is calculated by subtracting direct expenses from net revenue, dividing the result by net revenue and multiplying by 100%.

(Net revenue – direct expenses) Net revenue x 100% = Gross profit margin ratio

A higher gross profit margin, means the company has more cash to pay for indirect and other costs such as interest and one-time expenses. This makes it an important ratio for helping business owners and financing professionals assess a company’s financial health.

The gross profit margin ratio is typically used to track a company’s performance over time or to compare businesses within the same industry.

More about the gross profit margin ratio

From the income statement below, ABC Co.’s net revenue is $100,000 and direct expenses are $35,000, so its gross profit margin ratio would be as such:

($100,000 – $35,000) / $100,000 x 100% = 65%

A gross profit margin ratio of 65% is considered to be healthy.

How do you calculate profit margin percentage?

You can calculate all three by dividing the profit (revenue minus costs) by the revenue. Multiplying this figure by 100 gives you your profit margin percentage.

What is a gross profit margin example?

Gross margin is your business’s net sales minus your cost of goods sold (COGS). Basically, gross margin is the revenue your company has after incurring direct costs from producing your goods or services. … For example, if your gross margin is 40%, you are earning $0.40 for each dollar of revenue you earn.

How do you calculate gross profit example?

You can find the gross profit by subtracting the cost of goods sold (COGS) from the revenue. For example, if a company had $10,000 in revenue and $4,000 in COGS, the gross profit would be $6,000. This figure is on your income statement.

What is the formula to calculate profit?

The formula to calculate profit is: Total Revenue – Total Expenses = Profit. Profit is determined by subtracting direct and indirect costs from all sales earned. Direct costs can include purchases like materials and staff wages.