Managing your personal finances can be challenging, especially when you have multiple accounts, bills, debts, investments, and goals to keep track of. Fortunately, there are many apps that can help you simplify your money management and achieve your financial objectives. Whether you want to create a budget, track your spending, save more, invest smarter, or pay off debt faster, there is an app for you.

In this article, we will review 10 of the best personal finance apps for android and ios that you can download and use today. These apps are selected based on their features, ratings, reviews, and popularity. We will also highlight the pros and cons of each app, as well as the cost and availability.

Mint

Mint is one of the most popular and comprehensive personal finance apps that lets you see your complete financial picture in one place. You can link your bank accounts, credit cards, loans, investments, and bills to Mint and get a real-time overview of your net worth, cash flow, budget, credit score, and more. Mint also provides personalized tips and insights to help you improve your financial habits and reach your goals.

Mint is designed to help you manage your money effortlessly and automatically. Mint categorizes your transactions and shows you how much you spend on each category. You can also create custom categories and budgets to suit your needs. Mint alerts you when you are over budget or when you have low balance or unusual activity in your accounts. Mint also monitors your credit score and gives you tips on how to improve it.

Mint also helps you track your investments and see how they perform over time. You can see your portfolio balance, asset allocation, fees analysis, and more. Mint also compares your portfolio with the market benchmarks and suggests ways to optimize your returns.

Mint is free to use and available on both android and ios platforms.

- Pros: Free, easy to use, extensive features, customizable budgeting and spending categories, credit score monitoring, bill reminders, investment tracking.

- Cons: Ads can be annoying, syncing issues with some banks, limited customer support.

YNAB (You Need A Budget)

YNAB is a powerful budgeting app that helps you gain control of your spending and save more money. YNAB is based on four rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money. These rules help you plan ahead for your expenses, adjust your budget as needed, and break the paycheck-to-paycheck cycle. YNAB also offers online classes, podcasts, blogs, and videos to teach you how to budget effectively.

YNAB is designed to help you create a zero-based budget, which means that every dollar of your income is assigned to a specific category or goal. YNAB helps you track your spending and shows you how much money you have left in each category. You can also set goals for saving or paying off debt and see your progress over time.

YNAB also helps you deal with unexpected expenses and changes in your income. YNAB allows you to move money between categories and adjust your budget as needed. YNAB also encourages you to age your money which means that you spend money that you earned at least a month ago and avoid living on the edge.

YNAB costs $14.99 per month or $99 per year after a 34-day free trial. It is available on both android and ios platforms.

- Pros: Detailed budgeting and spending reports, goal tracking, debt payoff planner, bank syncing or manual entry options, excellent educational resources.

- Cons: Relatively high monthly cost, multiple features may overwhelm new users.

Empower (Formerly Personal Capital)

Empower is a wealth management app that helps you manage your money across various accounts and optimize your investments. Empower lets you link your bank accounts credit cards loans retirement accounts and brokerage accounts to see your net worth cash flow portfolio performance asset allocation fees analysis retirement readiness and more. Empower also provides access to certified financial planners who can give you personalized advice on how to grow your wealth.

Empower is designed to help you see the big picture of your finances and make smart decisions for the future. Empower shows you how much money you have in each account and how much money you earn and spend each month. Empower also helps you create a budget and track your spending habits.

Empower also helps you manage your investments and see how they perform over time. Empower shows you your portfolio balance asset allocation fees analysis and more. Empower also compares your portfolio with the market benchmarks and suggests ways to optimize your returns.

Empower also helps you plan for retirement and see if you are on track to achieve your goals. Empower shows you your retirement readiness score and how much you need to save and invest each month. Empower also provides access to certified financial planners who can give you personalized advice on how to reach your retirement goals.

Empower is free to use for the basic features and charges 0.89% annually for the wealth management service. It is available on both android and ios platforms.

- Pros: Free for basic features comprehensive investment tools and insights access to financial advisors.

- Cons: High fees for wealth management service ($100K minimum) limited budgeting features.

Prism

Prism is a bill payment app that helps you manage all your bills in one place and never miss a due date. Prism lets you link your bank accounts and credit cards to pay your bills directly from the app. You can also link your billers to see your balances, due dates, and payment history. Prism sends you reminders when your bills are due and notifies you when your payments are confirmed.

Prism is designed to help you simplify your bill management and avoid late fees and penalties. Prism shows you all your bills in one place and lets you choose when and how to pay them. You can also schedule your payments in advance or pay them manually. Prism supports over 11,000 billers including utilities, phone, internet, cable, insurance, credit cards, loans, and more.

Prism is free to use and available on both android and ios platforms.

- Pros: Free, easy to use, bill payment service, bill tracking feature.

- Cons: Syncing issues with some billers, no budgeting or saving features.

Spendee

Spendee is a shared expense app that helps you manage your money with your family, friends, or roommates. Spendee lets you create shared wallets with different people and track who paid for what and how much each person owes or is owed. Spendee also lets you create budgets and track your income and expenses across various categories and currencies.

Spendee is designed to help you split expenses and settle debts with ease. Spendee shows you how much money you have in each wallet and how much money you spend on each category. You can also add transactions manually or automatically by linking your bank accounts or cards. Spendee supports over 150 currencies and allows you to convert them automatically.

Spendee is free to use for the basic features and offers premium plans starting from $2.99 per month or $22.99 per year. It is available on both android and ios platforms.

- Pros: Free for basic features, shared expense feature, budgeting feature, multi-currency support.

- Cons: Premium plans required for some features, syncing issues with some banks.

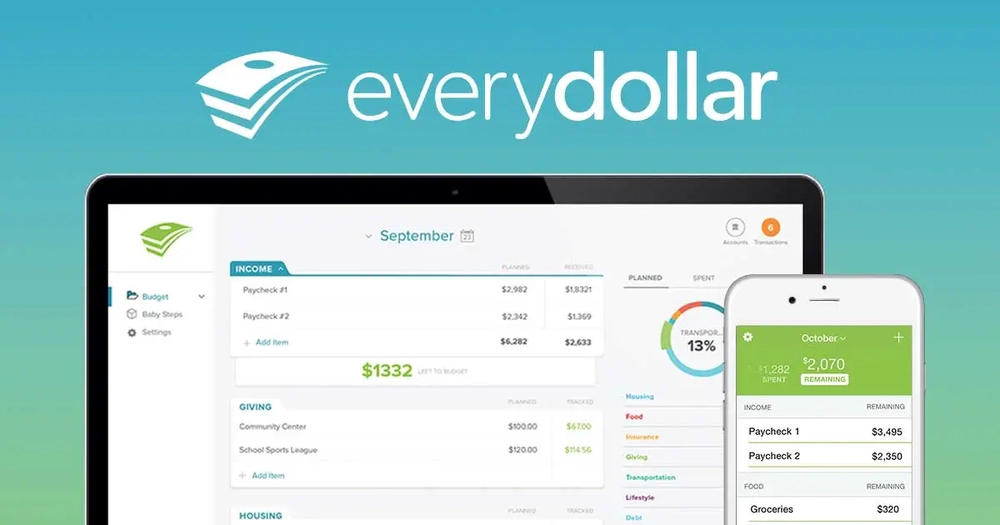

EveryDollar

EveryDollar is a budgeting app that helps you create a zero-based budget and track every dollar you earn and spend. EveryDollar follows the 7 Baby Steps of Dave Ramsey a popular personal finance expert and author. EveryDollar helps you allocate your income to your expenses savings and debt payments and track your progress towards your goals.

EveryDollar is designed to help you follow the 7 Baby Steps of Dave Ramsey which are:

- Save $1,000 for your starter emergency fund.

- Pay off all debt (except the house) using the debt snowball.

- Save 3–6 months of expenses in a fully funded emergency fund.

- Invest 15% of your household income in retirement.

- Save for your children’s college fund.

- Pay off your home early.

- Build wealth and give generously.

EveryDollar shows you how much money you have left in each category after allocating your income. You can also set goals for each step and see how far you are from reaching them. EveryDollar also provides access to Ramsey+ membership, which includes online courses, coaching, podcasts, books, and more.

EveryDollar is free to use for the basic features and offers a plus plan for $129.99 per year that includes bank syncing and access to Ramsey+ membership. It is available on both android and ios platforms.

- Pros: Free for basic features, zero-based budgeting feature, goal tracking feature, access to Ramsey+ membership.

- Cons: Plus plan required for bank syncing, limited customization options.

Money View

Money View is a personal finance management app that helps you manage your money in India. Money View lets you link your bank accounts and credit cards to see your balances transactions and spending patterns. Money View also helps you create budgets track your bills save money with smart offers and apply for loans and credit cards.

Money View is

designed to help you manage your money in India and cater to your specific needs and preferences. Money View shows you your balances transactions and spending patterns across your bank accounts and credit cards. You can also create budgets and track your spending habits.

Money View also helps you track your bills and reminds you when they are due. You can also pay your bills directly from the app and get cashback and rewards. Money View supports over 200 billers including utilities, phone, internet, cable, insurance, credit cards, loans, and more.

Money View also helps you save money with smart offers and apply for loans and credit cards. You can find the best deals on various products and services and save up to 30% on your purchases. You can also apply for personal loans and credit cards and get instant approval and disbursal.

Money View is free to use and available on both android and ios platforms.

- Pros: Free, easy to use, tailored for Indian users, loan and credit card offers.

- Cons: Ads can be intrusive, limited investment features.

PocketGuard

PocketGuard is a budgeting app that helps you lower your bills, optimize your spending, and save more money. PocketGuard lets you link your bank accounts, credit cards, loans, and investments to see your net worth, cash flow, budget, and savings potential. PocketGuard also helps you negotiate lower rates on your bills, find better deals on your recurring subscriptions, and discover new ways to save money.

PocketGuard is designed to help you find the hidden money in your budget and put it to better use. PocketGuard shows you how much money you have in your pocket which is the amount of money you can safely spend after paying your bills and saving for your goals. PocketGuard also shows you how much money you can save each month by lowering your bills or cancelling unnecessary subscriptions.

PocketGuard also helps you negotiate lower rates on your bills such as cable, internet, phone, insurance, and more. You can save up to 25% on your monthly bills by letting PocketGuard negotiate on your behalf. PocketGuard also helps you find better deals on your recurring subscriptions such as streaming services, music apps, fitness apps, and more. You can save up to 50% on your monthly subscriptions by switching to cheaper or free alternatives.

PocketGuard is free to use for the basic features and offers a plus plan for $7.99 per month, $34.99 per year, or $79.99 for lifetime access. It is available on both android and ios platforms.

- Pros: Free for basic features, bill negotiation service, subscription cancellation service, savings suggestions.

- Cons: Plus plan required for some features, limited customer support.

Stash

Stash is an investing app that helps you start investing with as little as $1 and learn the basics of the stock market. Stash lets you choose from hundreds of stocks and ETFs that match your interests, goals, and risk level. Stash also provides educational content, personalized guidance, and tools to help you build a diversified portfolio and grow your wealth over time.

Stash is designed to help you invest in what matters to you and learn as you go. Stash shows you different categories of stocks and ETFs that reflect your values, interests, and goals. You can choose from themes such as innovation, social responsibility, diversity, and more. You can also invest in individual stocks of companies that you know and love.

Stash also helps you invest with confidence and learn the basics of the stock market. Stash provides educational content, personalized guidance, and tools to help you understand how investing works and how to make smart decisions. You can also access various features such as fractional shares, automatic investing, portfolio diversification, and more.

Stash costs $3 or $9 per month depending on the plan you choose. It is available on both android and ios platforms.

- Pros: Low minimum investment, fractional shares, curated investment options, educational resources.

- Cons: Monthly fees, limited investment choices, no tax-advantaged accounts.

Honeydue

Honeydue is a budgeting app for couples that helps you manage your money together and stay on the same page. Honeydue lets you link your bank accounts and credit cards to see your balances, transactions, and spending habits. Honeydue also lets you create budgets, track bills, set goals, and chat with your partner about money matters.

Honeydue is designed to help you collaborate with your partner on your finances and avoid money conflicts. Honeydue shows you how much money you have in each account and how much money you spend on each category. You can also create budgets and track your spending habits.

Honeydue also helps you communicate with your partner about money matters and keep each other accountable. Honeydue allows you to chat with your partner within the app and send comments or emojis on each transaction. You can also set goals for saving or paying off debt and see your progress over time.

Honeydue is free to use and available on both android and ios platforms.

- Pros: Free, easy to use, budgeting feature, communication feature.

- Cons: Syncing issues with some banks, no shared expense feature.