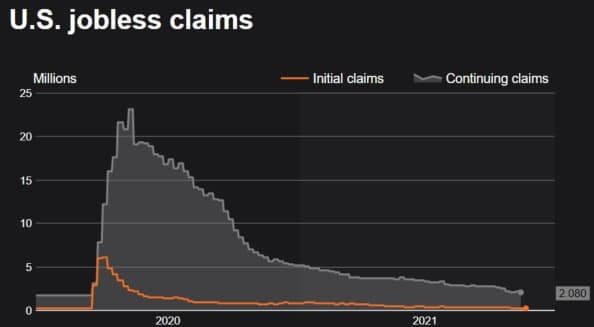

US jobless claims hit 52-year low after seasonal adjustments

The number of Americans applying for unemployment benefits plummeted last week to the lowest level in more than half a century, another sign that the U.S. job market is rebounding rapidly from last year’s coronavirus recession

Applications for U.S. state unemployment benefits plunged last week to a level not seen since 1969, which if sustained would mark the next milestone in the labor market’s uneven recovery.

Initial unemployment claims in regular state programs fell by 71,000 to a seasonally adjusted 199,000 in the week ended Nov. 20, Labor Department data showed Wednesday. The median estimate in a Bloomberg survey of economists called for 260,000 applications.

The number of Americans applying for unemployment benefits plummeted last week to the lowest level in more than half a century, another sign that the U.S. job market is rebounding rapidly from last year’s coronavirus recession.

Jobless claims dropped by 71,000 to 199,000, the lowest since mid-November 1969. But seasonal adjustments around the Thanksgiving holiday contributed significantly to the bigger-than-expected drop. Unadjusted, claims actually ticked up by more than 18,000 to nearly 259,000.

also read :

- Cardano-Based Ardana Will Build a Cross-Chain Bridge Between Cardano and NEAR. Who Has Built the First-Ever Cardano- NEAR Bridge ?

- Hailee Steinfeld of ‘Hawkeye’ : the next big star of the Marvel universe. Avenger’s dark past comes back to haunt him

- The Devils’ Third Jersey Has Arrived : New Jersey Devils Unveil Uniforms Celebrating Hockey History. How Martin Brodeur helped ?

- Vigilante “Batman” in California Claims They Caught a Double-Homicide Suspect. Vigilante Who Calls Himself The ‘Stockton Batman’ Claims To Have Captured Double-Murder Subject

- Eddie Redmayne : Oscar-nominated trans role (transgender pioneer Lili Elbe) in ‘The Danish Girl’ was ‘a mistake’

What Are Jobless Claims?

Jobless claims are a statistic reported weekly by the U.S. Department of Labor that counts people filing to receive unemployment insurance benefits. There are two categories of jobless claims—initial, which comprises people filing for the first time, and continuing, which consists of unemployed people who have already been receiving unemployment benefits. Jobless claims are an important leading indicator on the state of the employment situation and the health of the economy.

During the economic downturn caused by the spread of the COVID-19 virus, weekly jobless claims in the U.S. soared to historical levels as companies reduced their payrolls as business was halted due to social distancing. More than 28 million Americans filed for unemployment from mid-March to April 30, according to the U.S. Labor Department.

How Jobless Claims Affect the Market ?

As mentioned, the initial jobless claims measure emerging unemployment and the continued claims data measure the number of people still claiming unemployment benefits. The continued claims data is released one week later than the initial claims. For this reason, the initial claims usually have a higher impact on the financial markets.

Why Jobless Claims Matter to Investors ?

Sometimes markets will react strongly to a mid-month jobless claims report, particularly if it shows a difference from the cumulative evidence of other recent indicators. For instance, if other indicators are showing a weakening economy, a surprise drop in jobless claims could slow down equity sellers and could actually lift stocks. Sometimes this happens simply because there isn’t any other recent data to chew on at the time. A favorable initial jobless claims report may also get lost in the shuffle of a busy news day and hardly be noticed by Wall Street.